Dean's Note on Alternative Investments: Unlocking New Potential for Financial Planners

Welcome to the Golden Era of Alternatives

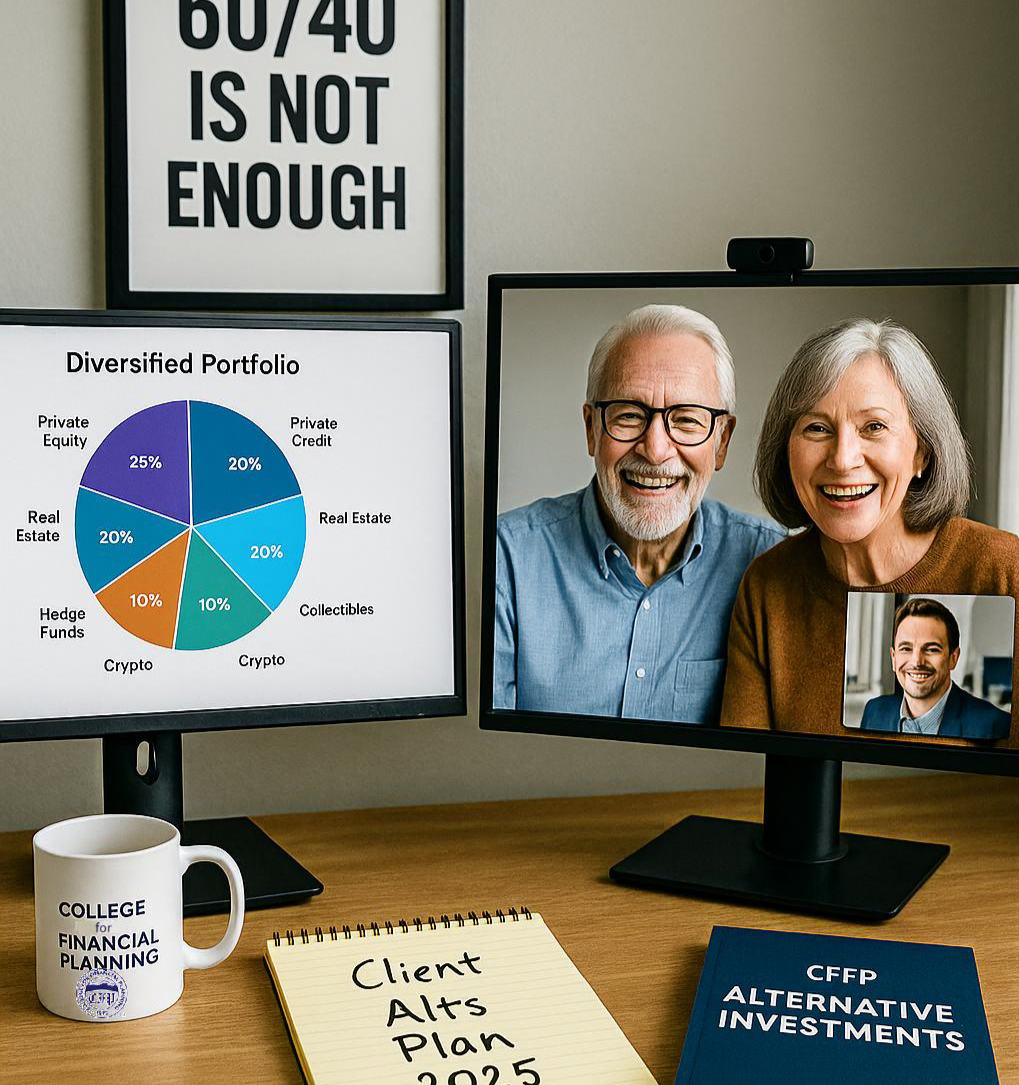

If you're a financial planner still relying on the classic 60/40 allocation, you're missing what's happening in the real world and what clients are already talking about. Alternative investments are now mainstream, accessible, and, when used wisely, can transform portfolios for a much wider range of investors. They account for over 15% of global investable assets and are continuing to grow.

Five Reasons Alts Should Excite Financial Planners

- Diversification that Works: Tired of stocks and bonds falling together? Alts offer real, uncorrelated return streams.

- Access to Private Market Growth: Some of the best opportunities may never reach public markets. Alts are your clients' ticket.

- Yield and Income Restored: Private credit, real estate, and infrastructure can offer the income that bonds no longer do.

- Inflation Protection: Real assets and infrastructure aren't just buzzwords; they're essential components of sophisticated portfolios that help fight inflation.

- Win More Business, Build Stronger Relationships: Client Demand Is Exploding. Mastering alt sets you apart, builds trust, and elevates your practice.

Major Alternative Asset Classes

Private Equity

- What it is: Direct investments in private companies - venture capital, growth equity, and buyouts.

- Why it's exciting: Access to high-growth companies never seen in public markets. Potential for outsized returns in the right hands - especially as valuations reset. Not just for the ultra-wealthy anymore.

- Common Myth: "If I can get in, it must be a winner." Reality: Most PE funds underperform the top quartile, and access is not a guarantee of success.

- Watch Out For: Long lock-ups, high fees, significant differences between managers, opaque valuations.

- Client Biases: Overconfidence, exclusivity, recency bias.

- Frame the Conversation:

- "Access is only valuable if matched with manager skill and patience."

- "How comfortable are you having money tied up for 7–10 years?"

Hedge Funds

- What it is: Private partnerships using strategies from long/short to macro and event-driven, aiming for returns in all markets.

- Why it's exciting: Alpha opportunities in volatile markets; tools for managing downside, not just riding the bull.

- Common Myth: "Hedge funds always beat the market." Reality: The average hedge fund lags low-cost index funds after fees.

- Watch Out For: High fees, lack of transparency, star manager chasing.

- Client Biases: Chasing past winners, mystique, survivorship bias, and status.

- Frame the Conversation:

- "Hedge funds are tools, not magic. Let's focus on process and discipline."

- "Is this about strategy or prestige?"

Real Estate (Direct, REITs, Private Funds)

- What it is: Property investment through direct ownership, Real Estate Investment Trusts, or private partnerships.

- Why it's exciting: Income, inflation protection, and now global and niche access. Tangible, familiar, and more diverse than ever.

- Common Myth: "Real estate always goes up." Reality: Real estate cycles can be brutal—location, leverage, and timing matter.

- Watch Out For: Illiquidity, leverage, regional risk, "drive by it" fallacy.

- Client Biases: Familiarity, home, recency, anchoring.

- Frame the Conversation:

- "Let's look beyond the familiar, global, and specialty real estate to open new doors."

- "Are you prepared for periods when real estate lags or locks up your cash?"

Infrastructure

- What it is: Ownership or financing of essential assets - roads, energy grids, water, renewables, digital infrastructure.

- Why it's exciting: Attractive yields, inflation-linked revenues, societal value, and is the backbone of tomorrow's economy.

- Common Myth: "All infrastructure is safe like utilities." Reality: Greenfield projects and emerging markets can carry high risks and delays.

- Watch Out For: Project risk, duration, complex fee layers, ESG halo.

- Client Biases: Stability illusion, yield chase, complexity, ESG overconfidence.

- Frame the Conversation:

- "Core infrastructure is stable, but not all projects are equal. Let's review the spectrum."

- "Yield comes with unique risks, let's unpack them."

Private Credit

- What it is: Direct lending to companies or projects—private loans, mezzanine, distressed debt.

- Why it's exciting: High yields, floating rates, new sources of income beyond banks.

- Common Myth: "Private credit is safe like a bond." Reality: Many loans are below investment grade and can be illiquid in crises.

- Watch Out For: Illiquidity, default risk, untested in severe downturns.

- Client Biases: Yield obsession, illiquidity blindness, recency, underappreciated risk.

- Frame the Conversation:

- "High yield means high risk—credit and liquidity. Let's stress test before allocating."

- "How would a loss or redemption gate affect your plan?"

Collectibles & Passion Assets

- What it is: Tangible items like art, classic cars, rare wine, watches, sports memorabilia, and NFTs. Example: Fine art, vintage Patek Philippe, Bored Ape NFTs.

- Why it's exciting: Personal passion meets potential appreciation; true portfolio diversifier, and "bragging rights."

- Common Myth: "All rare collectibles appreciate over time." Reality: Fads fade, liquidity dries up, and costs can kill returns.

- Watch Out For: Emotional attachment, illiquidity, costs, trend chasing.

- Client Biases: Emotion, scarcity, overconfidence, ignoring costs.

- Frame the Conversation:

- "If you love it, great, just don't let emotion drive the investment."

- "Would you own this if it weren't fun or personal? If not, keep it small."

Digital Assets (Crypto, DeFi, Tokenized Assets)

- What it is: Cryptocurrencies (Bitcoin, Ethereum), decentralized finance (DeFi) tokens, non-fungible tokens (NFTs), tokenized real-world assets. Example: BTC, ETH, Compound, tokenized real estate.

- Why it's exciting: Innovation, decentralization, potential for outsized returns, client interest off the charts.

- Common Myth: "Crypto is guaranteed wealth." Reality: Extreme volatility, fraud, hacks, and regulatory risk mean it can go to zero.

- Watch Out For: Volatility, regulatory uncertainty, irrecoverable loss, hype.

- Client Biases: FOMO, overconfidence, recency bias, and the illusion of control.

- Frame the Conversation:

- "Crypto is exciting but dangerous—let's only risk what you can lose."

- "Would a total loss derail your plan? If so, rethink the allocation."

The financial planner of the future leads with discipline, curiosity, and confidence:

- Separate hype from reality.

- Spot client biases—and your own.

- Match alts to real-world goals and risk tolerance.

- Guide conversations around suitability, not just excitement.

Your Next Moves

- Open conversations about both opportunities and risks are your teaching moments, as client biases become apparent.

- Level up with new education: The College for Financial Planning (CFFP) offers in-depth alts coursework.

- Tell stories and use real-world analogies; clients remember these best.

- Stay curious and adapt: The alt landscape is evolving, so should you.

What's YOUR Experience?

- What's the most exciting alt you've explored or allocated this year?

- Where have clients surprised you, positively or negatively, in their adoption of alternatives?

- What's the #1 risk or misconception you see in the marketplace now?

Join the conversation, share your stories, and let's lead the way in modern wealth management.